Have you been pondering your business exit strategy? Provided that this is true, you’ve presumably viewed various choices, from starting public contributions to liquidation.

However, in case you’re similar to numerous business proprietors, basically closing the entryways for great isn’t what you had as a primary concern when you began your company. Noted Astro Strategist cum Business Astrologer Hirav Shah says, “business is for gladiators.” You put in the difficult work, and you merit a prize. On the off chance that you are prepared to sell and move to seek after your next energy, you might need to think about a leveraged buyout.

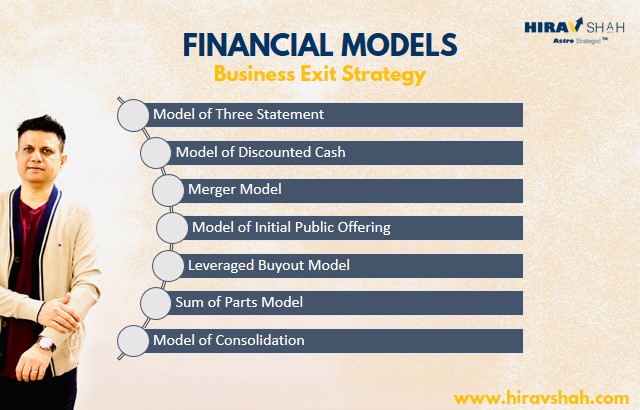

Hirav Shah says, “Financial modelling is the process of developing a fiscal representation of a business entity. In financial analysis, it is one of the most highly valued skills. This is why a comprehensive financial modelling course can provide numerous promising career options. These models are used to assess the valuation of a business. They also are used in calculated planning to test various scenarios, to understand and estimate the cost of new projects, determine annual budgets, allocate corporate resources, and attract investments.”

Financial models can be of various types with a wide range of applications.

Table of Contents

The following types of financial models are the most popular ones:

- Model of Three Statement

- Model of Discounted Cash

- Merger Model

- Model of Initial Public Offering

- Leveraged Buyout Model

- Sum of Parts Model

- Model of Consolidation

- Budget Model

- Forecasting Model

- Model of Option Pricing

WHAT IS A LEVERAGED BUYOUT?

Hirav Shah explains, “It is considered to be an LBO when an investor acquires a business, company, division, or any assets of the company using a lot of debt. As collateral for the loan, the assets being acquired are used and if the collateral falls short, the acquirer might also have to pledge his own assets.

“A leveraged buyout additionally called an LBO, is a financial transaction wherein a company is bought with a mix of equity and debt so the company’s cash flow is the collateral used to get and reimburse the acquired cash. As such, a leveraged buyout is a point at which one company secures another utilizing a lot of financing, which means the buyout is subsidized with debt. The company doing the obtaining in a leveraged buyout, regularly a private equity firm will utilize its resources as an influence. The resources and cash flows of the company that is being procured (called the target company or merchant) are additionally utilized as collateral and to pay for the financing cost,” says Hirav Shah.

Hirav Shah adds, “The motivation behind an LBO is to permit a company to make a significant acquisition without submitting a ton of capital. In the most ordinary leveraged buyout model, there is a proportion of 90% debt to 10% equity. While a leveraged buyout can be convoluted and require a significant stretch of time to finish, it can profit both the purchaser and dealer when done effectively.”

For what reason DO BUSINESS USE LBOS?

A leveraged buyout is frequently essential for a mergers and acquisitions (M&A) strategy. They’re additionally now and then used to procure the opposition and to enter new markets to assist a company with differentiating its portfolio. Purchasers like leveraged buyouts since they don’t need to place in a whole lot their own cash, permitting them to report a higher inside pace of return (IRR). So, LBOs permit firms better equity returns.

For what reason would a target company need to sell by means of LBO? It’s really a moderately basic technique for selling a business. The merchant can get the value they need for the business and has an approach to exit the company with a strong arrangement set up. A leveraged buyout is an ideal exit strategy for business proprietors hoping to cash out toward the finish of their vocations.

According to Hirav Shah, here are some extra reasons why a business proprietor would think about a leveraged buyout:

1. TO MAKE A PUBLIC COMPANY PRIVATE

In the event that you run a trade on an open market company, you can utilize a leveraged buyout to unite the public offers and move them to a private financial backer who takes the offers off the market. The financial backers will at that point own a greater part of or the entirety of your company and will expect the debt responsibility of the transaction. For instance, an LBO is helpful if the business should be repackaged and gotten back to the marketplace after changes are made to make it more marketable. At the point when the company is brought back to the market as the first sale of stock (IPO), it tends to be done as such with the show, reestablishing the public’s premium in the company.

2. TO BREAK UP A LARGE COMPANY

Numerous business proprietors have utilized productivity systems to make their organizations beneficial and alluring to likely purchasers. Nonetheless, a few organizations develop so hugely and wastefully that it turns out to be more beneficial for a purchaser to utilize a leveraged buyout to split it up and sell it as a progression of more modest organizations. These individual deals ought to be all that could possibly be needed to take care of the advance of buying the company all in all. On the off chance that you have a company with various target markets for different items, this may be a decent choice. An LBO of this sort would then be able to allow the more modest organizations a superior opportunity to develop and stand apart than they would have had as a component of a wasteful combination.

3. TO IMPROVE A COMPANY THAT IS UNDERPERFORMING

On the off chance that a financial backer accepts your company could, at last, be worth a lot more than it is right now, a leveraged buyout could be a decent alternative. The financial backer would expect the debt with the conviction that clutching the company for a specific measure of time will build its esteem and permit them to take care of the debt and make a benefit. In this kind of leveraged buyout, you as the business proprietor would need to exit the company before it becomes beneficial, however not penance the benefit that is probably going to come later on. Taking the LBO cash from the buyer assists you with acknowledging part of that benefit now so you can turn your sights to different endeavours.

4. TO ACQUIRE A COMPETITOR

Another regularly leveraged buyout happens when a more modest company needs to be obtained by a bigger contender. This permits the more modest company to develop drastically and can help them acquire new clients and scale more rapidly than they would have the option to without the acquisition. Regularly, the getting company will keep your vital staff set up so you don’t need to stress that the group you painstakingly picked will be left without a task. This can be a decent method to welcome different financial backers and proficient pioneers ready and exploit peer elevation.

With a more strong and changed group set up, you can take a formerly failing to meet expectations of a company higher than ever on the off chance that you need to remain on with the company. Numerous business proprietors sell their company by means of a leveraged buyout yet stay on as an advisor to hold associations and help the business keep on developing. Other business proprietors utilize an LBO as an approach to exit the company totally to seek after one where they have more enthusiasm just as a benefit.

BENEFITS OF LEVERAGED BUYOUTS

According to Hirav Shah, LBOs enjoy clear benefits for the purchaser: they will go through less of their own cash, get a better yield on speculation and help turn organizations around. They see a greater profit from equity than with other buyout situations since they’re ready to utilize the dealer’s resources to pay for the financing cost as opposed to their own. An LBO can likewise bring down a business’ available pay so the purchaser acknowledges tax cuts they didn’t have previously.

For the dealer, one of the principal benefits of a leveraged buyout is the capacity to sell a business that probably won’t be at its pinnacle execution yet at the same time has cash flow and the potential for development. On the off chance that an LBO improves a company’s market position – or even saves it from disappointment – the investors and workers remain to profit. On the off chance that the purchaser is the current administration, workers can likewise profit from chiefs that are presently more occupied with the business, since they own a bigger stake. A leveraged buyout likewise permits gatherings, for example, representatives or relatives to obtain a company, if, for instance, the current proprietor is resigning, which can likewise prompt more noteworthy commitment. At long last, if the target company is secretly held, the vendor could understand charge benefits from the LBO.

CRITICISMS OF LEVERAGED BUYOUTS

Hirav Shah says, “In an LBO, the very influence that permits a more prominent award additionally accompanies more serious danger. For the purchaser, there is a little edge for a blunder, and in the event that they’re not ready to take care of the debt, they’ll get no return by any stretch of the imagination. Contingent upon how the purchaser characterizes hazard and how hazard open-minded the person is, this could be appealing or it very well may be a wellspring of uneasiness.

The dangers of a leveraged buyout for the target company are additionally high. Loan fees on the debt they are taking on are regularly high and can bring about a lower credit score. On the off chance that they’re not able to support the debt, the final product is chapter 11. LBOs are particularly hazardous for organizations in profoundly aggressive or unpredictable markets.

Besides hazard, there are a few criticisms of leveraged buyouts that merit consideration. Since the company will regularly zero in on reducing expenses, present buyout all together on repaying the debt all the more rapidly, LBOs at times bring about cutting back and cutbacks. They can likewise imply that the company doesn’t make interests in things like hardware and land, prompting diminished seriousness in the long haul.

Another analysis of LBOs is that they can be utilized in a savage way. One way that this happens is the point at which the administration of a company puts together an LBO to sell it back to themselves and gain momentary individual benefit. Savage purchasers can likewise target weak organizations, take them secretly utilizing an LBO, split them up and auction resources – at that point basically bow out of all financial obligations and acquire an exceptional yield. This is the strategy private equity firms utilized during the 1980s and 1990s that prompted leveraged buyouts collecting a negative standing.

Leveraged buyouts aren’t generally savage. Yet, similarly as with any business choice, it’s essential to think about every one of the advantages and disadvantages prior to making all necessary endorsements.”

LEVERAGED BUYOUT EXAMPLES

To genuinely comprehend what a leveraged buyout is, you can investigate instances of both gainful and bombed LBOs. The $9 buyout of PetSmart in 2014 is one of the biggest leveraged buyout models. The buyout was performed by BC Partners, a British buyout firm that accepted they could improve the company’s market share by gaining by its online stages that had been recently disregarded. They bought Chewy.com in 2017 and took it public in 2019, raising almost $1 billion.

Another illustration of a leveraged buyout comes as the 1986 Safeway bargain, where Kohlberg Kravis Roberts (KKR) finished the amicable arrangement at a cost of $5.5 billion. Safeway’s board of directors agreed to keep away from a hostile takeover from Herbert and Robert Haft of Dart Drug. The buyout was financed for the most part with debt and the understanding that Safeway would strip a few resources and close failing to meet expected stores. At the point when Safeway was taken public in 1990 after numerous enhancements, KKR acquired nearly $7.3 billion on their underlying venture that totalled around $129 million.

Leveraged buyouts can even be effective in monetary plunges. Simply take a gander at the case of Blackstone’s LBO of Hilton Hotels in 2007 – just before the financial emergency. The economy dove and travel was particularly hard-hit. Blackstone at first lost cash, however, it endures because of its emphasis on administration and debt rebuilding. In 2013, Blackstone opened up to the world as much as $12 billion. Today it’s quite possibly the best LBOs ever.

Be that as it may, leveraged buyouts haven’t generally been effective. Since they have high debt-to-equity proportions, there’s a high danger of disappointment. Perhaps the most celebrated instance of an LBO turned out badly is Macy’s.

In 1985, Macy’s leaders coordinated a leveraged buyout that at the time was the biggest throughout the entire existence of retail. At that point, financial investigators figured it would profit the company – however, all things considered, it heaped on debt that the company couldn’t pay off. In 1992, with $6 billion in debt, Macy’s sought financial protection. In any case, they did in the end bob back, appreciating productivity for quite a few years prior to falling deals as of late prompted more inconveniences – this time not identified with leveraged buyouts.

IS MY COMPANY A GOOD CANDIDATE FOR A LEVERAGED BUYOUT?

There are five ordinary stages in the existing pattern of a business. Realizing which stage your company is in can assist you with choosing whether a leveraged buyout is a correct choice or on the off chance that you ought to delay selling.

The principal stage is the dispatch stage, where deals are commonly low however expanding. In the subsequent stage, called the development stage, deals increment quickly and you start making a benefit. This is the stage where you sharpen your contributions and endeavour to make your business talkable extraordinary. In the third stage, the shake-out, deals top or develop gradually and benefits decline because of new contenders entering the market and market immersion. Development, the fourth stage, is the place where numerous businesses start to deteriorate and overall revenues get more slender. Some business proprietors can expand this phase of the cycle by utilizing consistent key development or entering new markets. The fifth and last stage is decay, which is set apart by contracting benefits and deals and typically finishes with the business proprietor escaping the market.

Regardless of whether your business is at top execution and you need to underwrite or your business is arriving at the fifth phase of the existence cycle and you’re considering retirement, an LBO could be a decent alternative for you. LBOs give methods for an exit that are practical for some organizations.

SELLING YOUR COMPANY THROUGH A LEVERAGED BUYOUT

Contemplating selling your company through a leveraged buyout? On the off chance that your business has a positive monetary record, you’re destined for success. This implies you have things like substantial resources, great working capital and positive cash flows. Having a positive asset report implies banks are bound to loan to you. Firms hoping to gain organizations through a leveraged buyout commonly likewise search for demonstrated administration and a different, steadfast client base. They’ll need to see approaches to diminish costs rapidly, auctioning off non-centre resources or discovering synergies.

Your company doesn’t need to be working at the most extreme execution to be a decent possibility for a leveraged buyout. Organizations that might be battling because of a downturn in their industry or helpless administration yet at the same time have positive cash flow are likewise acceptable LBO up-and-comers. Financial backers may see a chance to make efficiencies and improve the business and along these lines be keen on getting it.

Settling on the choice to consider a leveraged buyout of your company isn’t something to be trifled with. You need to choose why you began the business in any case and on the off chance that you’ve accomplished the objectives you need to accomplish. How might you feel once you sell? Do you have an arrangement set up for your next endeavour or, in case you’re at retirement age, do you have enough in the bank or ventures to open the unprecedented life you want for your brilliant years?

Eventually, in case you’re asking yourself, “What is a leveraged buyout and would it work for my company?” you could profit by working with a business mentor who can assist you with considering points and settle on the best choice for you and your company. A business mentor can take a gander at the possibility equitably and without the feeling that you as the business proprietor will bring to the choice. With their assistance, you can settle on a strong choice that is best for your future.

In spite of some terrible press lately, a leveraged buyout is a reasonable exit strategy as a rule. Likewise, with any business choice, gauge the advantages and disadvantages prior to settling on your choice. With a little instinct, a great deal of examination and the assistance of a business mentor, you’ll settle on the correct decision and see huge individual and financial prizes.

Hirav Shah concludes by saying, “Leveraged Buyout is one of the most fascinating ways for those investors who are short of equity capital. They borrow money and then invest. The probability of a win-win situation depends on how you made the selection of a Leveraged Buyout candidate. If you have made the right choice and everything works out well then there is a high probability of earning huge returns.“