Navigating the world of business finance can often feel overwhelming, especially when you’re bombarded with terms that seem to require a financial degree to understand. As an entrepreneur, grasping these essential financial terms is key to making informed decisions that can pave the way for success. According to business strategist Hirav Shah, mastering these terms will not only help you achieve financial independence but will also enhance the stability and growth of your business.

While financial jargon can be complex, understanding the basics can set you on the path to financial freedom. With consistent learning and the right guidance, you’ll be well on your way to gaining control over your business’ finances and achieving your goals.

Here are five critical financial terms every entrepreneur should know:

Table of Contents

1. FICO Score: Your Credit Health

What is a FICO Score and How Does it Affect Your Business?

FICO stands for Fair Isaac Corporation, the company behind the credit scoring system used by lenders. Your FICO score is a reflection of your creditworthiness, impacting your ability to secure loans, business financing, or even business partnerships. The score ranges from 300 to 850, with higher scores indicating better credit health.

Key factors that influence your score:

- Payment History: Whether you pay your debts on time.

- Credit Utilization: How much of your available credit you’re using.

- Length of Credit History: The age of your credit accounts.

- Types of Credit: A mix of credit cards, mortgages, and installment loans.

- New Credit: How often you apply for new credit.

For instance, an entrepreneur with a FICO score of 650 may find it difficult to obtain business loans at favorable interest rates, while someone with a 750 score will have better access to capital. A strong FICO score can help you secure loans or lines of credit to fund business growth or expansion.

2. Lien: Protecting Creditors

What is a Lien and How Does it Affect Your Business?

A lien is a legal claim or right against an asset, typically used to secure a loan or debt repayment. If you fail to pay back the debt, the creditor has the right to seize the asset that the lien is placed upon.

For example, if you take out a loan to purchase equipment for your business, the lender might place a lien on that equipment until the loan is fully repaid. If you default on the loan, the lender can claim the equipment to recover their money.

Another type of lien is a tax lien. This occurs when tax authorities, like the IRS, place a claim on your business assets due to unpaid taxes. Tax liens are often a last resort after other collection methods have failed.

Example: If your business owes $100,000 in taxes and you fail to pay, the IRS might place a lien on your property to ensure the debt is eventually paid. This lien can negatively impact your credit and business operations.

3. Commercial Umbrella Insurance: Extra Protection for Your Business

Why Do You Need Commercial Umbrella Insurance?

While basic business liability insurance covers common risks, commercial umbrella insurance provides an additional layer of protection when your primary liability coverage limits are exceeded. This policy can cover the excess amount in situations like lawsuits, injuries, or property damage.

Let’s say you’re sued for $1 million due to an accident caused by your business operations, but your standard liability insurance only covers $800,000. With umbrella insurance, you can cover the remaining $200,000, ensuring your business isn’t left exposed.

Example: A customer slips and falls on your business premises and sues for damages. If the claim exceeds your general liability coverage, your commercial umbrella insurance will cover the difference, saving your business from financial catastrophe.

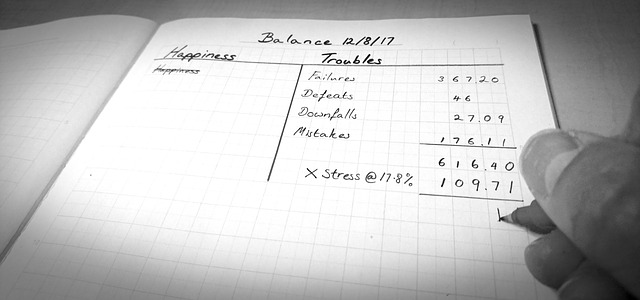

4. Balance Sheet: The Financial Snapshot

What is a Balance Sheet and Why Should You Care?

A balance sheet provides a snapshot of your business’ financial health at any given moment, detailing assets, liabilities, and shareholder equity. It’s an essential tool for understanding your business’s net worth.

- Assets: What your business owns, including cash, property, and inventory.

- Liabilities: What your business owes, such as loans and accounts payable.

- Equity: The difference between assets and liabilities, representing the ownership value of your business.

Example: If your business has $500,000 in assets, but $200,000 in liabilities, the business equity would be $300,000. This is the portion of your business that’s truly yours, and it can be an indicator of your ability to secure financing or attract investors.

A strong balance sheet shows potential investors or lenders that your business is financially stable and capable of handling financial obligations, making it easier to obtain loans or investment.

5. Cash Flow Projections: Plan for the Future

What Are Cash Flow Projections and Why Do You Need Them?

Cash flow projections are estimates of the amount of cash your business expects to receive and pay out over a specific period, usually monthly or quarterly. These projections are vital for understanding how money is moving in and out of your business, and they help forecast future financial needs.

To create accurate projections, you can analyze past cash flow patterns and factor in expected income from sales, loans, or investments, as well as expected expenses like payroll, rent, and supplies.

For example, if your business is projected to make $50,000 in revenue next month but expects $30,000 in expenses, your net cash flow would be $20,000. This gives you insight into your available working capital, helping you plan for business growth or cover potential shortfalls.

Example: If your business experiences slow cash flow due to late payments from clients, cash flow projections can help you anticipate the need for short-term loans or financing to bridge the gap.

FAQs on Financial terms for business by Hirav Shah

Q1: How can I improve my FICO score?

To improve your FICO score, focus on paying off debts on time, reducing outstanding credit card balances, and avoiding applying for new credit too frequently. The higher your score, the easier it will be to secure financing at better rates.

Q2: How can commercial umbrella insurance help my business?

Commercial umbrella insurance acts as a safety net, covering costs that exceed your regular liability insurance. It ensures that your business is protected against catastrophic claims, helping you avoid a financial crisis.

Q3: What’s the difference between a tax lien and a regular lien?

A tax lien is placed by tax authorities when taxes are unpaid, and it’s typically a last resort after other collection methods are exhausted. A regular lien, on the other hand, is placed by a creditor to secure a debt that you owe, such as a loan or contract obligation.

Q4: How do cash flow projections help me manage my business?

Cash flow projections give you insight into your business’s future financial needs and help you plan accordingly. They allow you to anticipate shortfalls, manage expenses, and ensure your business has enough working capital to stay afloat during slower periods.

Conclusion: Taking Charge of Your Financial Future

Financial independence might seem out of reach, but by mastering the concepts of these financial terms, you can unlock the potential to grow and sustain your business. Whether it’s understanding your FICO score, knowing when you’re at risk of a lien, or forecasting future needs with cash flow projections, these terms form the foundation for solid business financial planning.

Hirav Shah, The Game Changer, advises that by using these concepts in your strategic business decisions, you’ll be setting yourself up for success. With the right knowledge and tools, you’ll not only achieve financial freedom but also build a stable, thriving business that stands the test of time.