HIRAV SHAH IS ON A MISSION TO TRANSFORM YOUR BUSINESS

Who is Hirav Shah?

Why earn less, when you have the potential to earn more?

Hirav Shah’s simple funda is if you are DOING business or BUYING business or STARTING any PROJECT, you should be able to make money as per POTENTIAL of BUSINESS or PROJECT.

Same way, If you are into POLITICS…power should be there. If you are an ENTERTAINER OR SPORTSMAN….you should be in the top 20, and you should be getting endorsement as per your face value…

If you are not able to make MONEY as per POTENTIAL of your business, means there must be some problem in your HARDWORK or STRATEGIES or EXECUTION or TALENT or LUCK.

Hirav is a pioneer in introducing the most popular ASTRO STRATEGY for Business revolution to increase CERTAINTY of SUCCESS.

“ACT” and “REACT” both are very important ingredients for any business.

Hirav’s Unique Approach

This unique approach originated from Hirav’s knowledge and global experience have made him a pioneering figure in the field of strategic optimization and sets him apart from other entrepreneurs who use their knowledge or experience or expert opinion to validate their calls. And now Astro Strategy is the first choice for all leading entrepreneurs, Hollywood, Bollywood, real estate developers, sportsmen, celebrities, politicians etc.

How to validate Any Strategic Call?

As per the man behind many globally successful brands, Hirav Shah “Exponential Growth can be achieved when you know where you are, where you want to go, why you want it, what’s the GAP between your goal and your current situation and finally what are the chances to achieve your goal”. Now the question is how to find the chances to achieve your goal?

There are only 3 ways to validate any strategical calls for any New or Existing Business or Real Estate Project or Sports Business or any Movie Project.

1. Knowledge,

2. Experience or an Expert’s opinion

3. Astro Strategy

From figuring out Business ROI, Profit, People Management, Sales, Marketing, Advertising, Branding, Image Building, Aquisition, Exit Strategy or to collaborate with any BIG BRANDS or to do JV or from choosing right script to leading cast and Crew to music to pre production, production, post production etc.

According to Hirav Shah, knowledge, experience, and validation are essential components for achieving exponential growth.

Knowledge, experience or an expert’s opinion alone may not always be enough to measure the chance of attaining long-term success without a reliable system in place.

From above 3 ways, Astro Strategy is the only TOOL that can provide you the certainty of the results of your actions in advance.

What is Astro Strategy?

Validation is the key for any strategic call. That’s how the most popular Astro Strategy, born child of an entrepreneur and an astro strategist Hirav Shah comes into picture which is the 80/20 rule is followed to ensure success: 80% of the result comes from Hard Work coupled with Mindset, Strategy, skills and Execution; 20% being attributed to luck.

Why Astro Strategy is most Popular ?

Astro Strategy can give you CLARITY on what are the CHANCES of REACHING Your GOAL. What Capabilities you need to improve, etc in advance before making any strategies or taking any massive action. And when you gain certainty, you can execute with more potential.

Astro Strategy can also provide you reliable support for any strategic decision with estimated resistance and support levels. This helps identify the capabilities that must be developed for success as well as indicate how likely the goal is to be achieved.

His knowledge of business strategy and business astrology and global experience have made him a leader in strategy optimization so that Astro Strategy is currently the go-to choice for prominent entrepreneurs, Hollywood stars, Bollywood celebrities, real estate developers, sports personalities and politicians.

Hirav as a Strategic Advisor

The business turnaround specialist, Hirav Shah is the top strategic advisor in the fields of Corporate Business, Real Estate, Sports, Hollywood, Bollywood, Tourism, Politics & more. Hirav Shah has an astounding global presence with clients based across various business sectors.

Hirav’s Message

This is the beginning of your new life, more success, more impact, more purpose, more freedom… But only if you choose to take action!! Yes, Massive Action!!!

The Hirav Shah Advantage

For any business to be successful, the key focus should be on developing a strong foundation. With Hirav Shah’s guidance, you can ensure that your bases are covered

With astro-strategy, you can answer puzzling questions such as:

Will I see success in this business and when?

When should I invite investment into my company?

When should I diversify or get into other products and services?

How do I ensure operational efficiency?

How do I venture into international markets?

What should be my exit strategy?

Have an existing/upcoming project on which you need Astro-Strategic guidance?

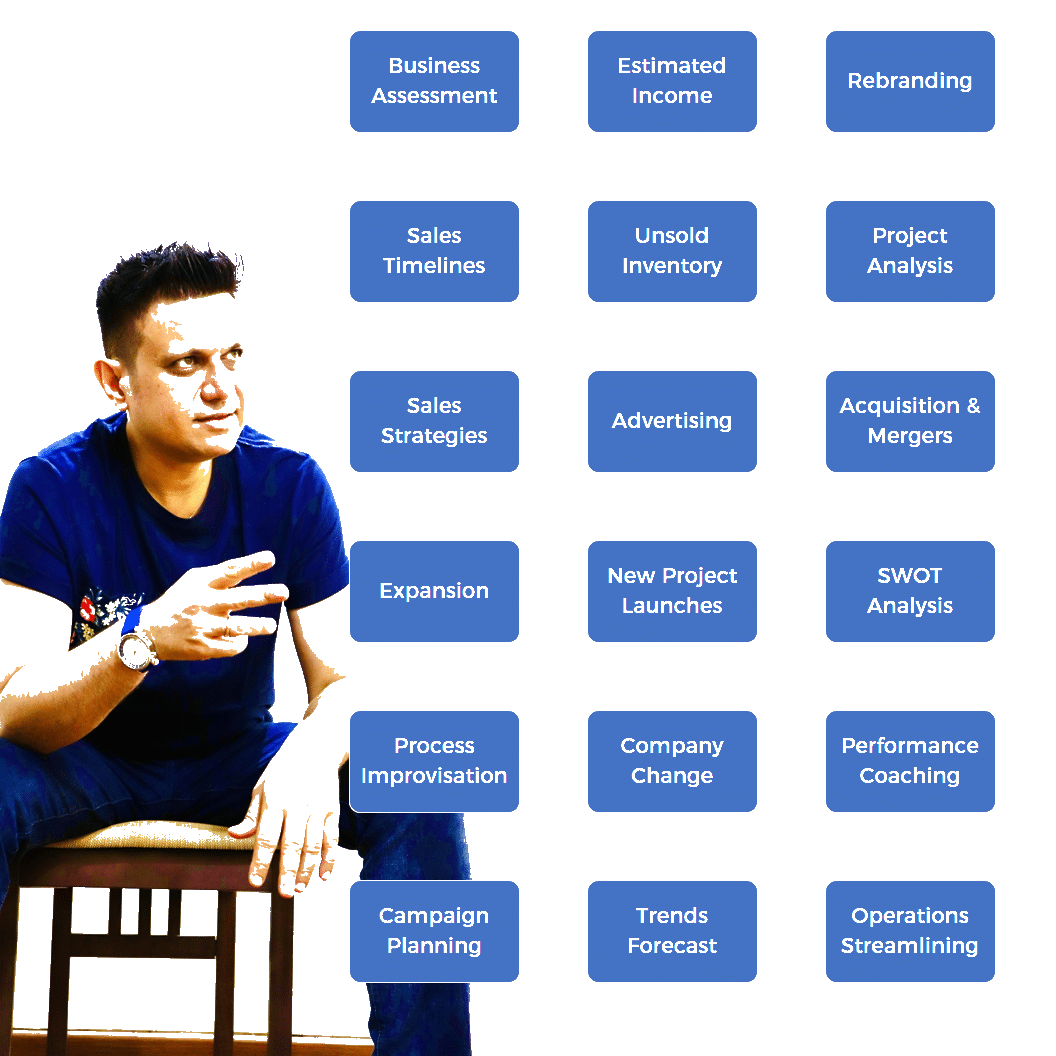

Hire Hirav Shah for

- A consultation: Short term engagement for a goal or campaign

- On a monthly retainer ship: Long term guidance for your firm lkjlkjlkj

- To avail Preliminary 10 minutes FREE STRATEGY SESSION with Hirav, WhatsApp your Business Details on +91-9687599923(INDIA) or +1-5516895323(USA)

Hirav’s Approach

Set a clear goal:

Helping you set SMART Goals (Specific, Measurable, Attainable, Relevant, and Time-Bound).

Identify Challenges in Your Path:

A strong understanding of the market landscape and obstacles you will face.

Weigh your options:

Formulating the best tools and tactics to achieve best case scenarios and avoid crushing failures.

Show you the way:

Give you a clear action plan which, when followed diligently, will help you achieve your SMART goals.

Our Services

A-Z Astro Strategic Opinion

For the very first time, businesses of any product or service from A to Z, can get an astro-strategic second opinion. Any confusion or difficult yes/no decision requires an expert opinion. You are just a question away from Hirav Shah. His answers have proven to be game changers.

Learn MoreReal Estate Inventories

Real estate developers like you are currently using the astrology consultation services of Hirav Shah for forecasting a timeline for their commercial and housing project sales.

Learn MoreBusiness Astrology

Why are my profits low? What are the causes of underperformance? Get all your questions answered by the renowned astro consultant Hirav Shah.

Learn MoreAdvertising Strategies

Astro consultation will give you a precise and timely promotional strategy for your ads.

Learn MoreMarketing Strategies

Learn how effective astrology consultation can be for a marketing strategy.

Learn MoreEstimated Income

Get astrology consultations for life decisions, so you have clarity on your finances.

Learn MoreWhy is Self-financing better than Venture Capital for Business funding?

Founders use venture capital funding for scaling a company. Founders who don’t have experience scaling or need specific advice and contacts in a new industry to scale can benefit from venture capital funding. Also, if the startup requires multiple funding rounds in the millions of dollars for growth or is in an untapped growing market, […]

Read more....10 Fitness Mistakes To Be Avoided

There are many Common Fitness Mistakes that people make while maintaining fitness. These mistakes can be avoided only when a fitness program is designed sensibly. Until you change, nothing changes. — Tells Hirav Shah, The Most Influential Brand Enhancement Expert and Renowned Advisor of our Country. Hirav Adds: “Whatever has happened, has happened… Now, let […]

Read more....Financial Protection: 8 Amazing Steps to Protection

In today’s unpredictable world, safeguarding your financial well-being is more crucial than ever. Whether you’re aiming for long-term stability or navigating through uncertain times, implementing effective financial protection strategies is essential. Here are eight amazing steps to help fortify your financial future. 1. Emergency Fund- Build a Safety Net Establishing an emergency fund is the […]

Read more....HAVE AN EXISTING/UPCOMING PROJECT ON WHICH YOU NEED ASTRO-STRATEGIC GUIDANCE?

Hire Hirav Shah for A consultation: short term engagement for a goal

or Campaign on a monthly retainer ship: Long term guidance for your firm

To avail Preliminary 10 minutes FREE STRATEGY SESSION with Hirav, WhatsApp your Business Details on +91-9687599923(INDIA) or +1-5516895323(USA))