Table of Contents

Introduction of Cryptocurrencies

A lot of developments and transformations have led to the growth of the cryptocurrency industry and hence in 2021, the crypto-market scene is also looking bright.

Renowned Business Strategist, Hirav Shah outlines 15 points below, signifying the future of Cryptocurrencies.

1. Many Have Entered This Space- Big banks, companies, and institutional investors such as JP Morgan, MicroStrategy, Tesla, and PayPal have entered the space.

2. Innumerable Numbers of Cryptocurrencies : There are over 9,000 cryptocurrencies in existence today.

3.Huge Market of Cryptocurrencies : The cryptocurrency market cap crossed the $2 trillion mark, of which Bitcoin alone accounts for $1.05 billion. The next top five cryptocurrencies’ cumulative value — Ether, Binance Coin, Polkadot, Tether and Cardano –stands at $422 billion.

4.Emerging Regulations of Cryptocurrencies : Emerging cryptocurrency regulations by governments across the world, formalizing the industry, lowering risks associated with crypto investments.

5. CBDC for Cryptocurrencies : The emergence of Central Bank Digital Currency (CBDC). A Central Bank Digital Currency is backed by a government’s central bank, which means they hold the liability, not your private bank. As decentralized digital currencies like bitcoin have become more popular the world’s central banks are beginning to realize they need to get in the game or let the evolution of money pass them by.

In April 2020, China became the first major economy to pilot a digital currency.

6. Cryptocurrencies Compared To Gold- Bitcoin has been compared to gold as a store of value.

7. Innovations for Cryptocurrencies : Innovative developments such as decentralised finance (DeFi) and Non-Fungible Tokens (NFTS).

8. Adoption of Cryptocurrencies : There is increasing adoption as governments across the world have started regulating the cryptocurrency industry and India too is embracing regulations in the crypto space.

9. New Doors For Indian Investors for Cryptocurrencies : In May 2020, The Supreme Court of India gave India the much needed boost in terms of cryptocurrency by overturning the cryptocurrency ban in India that was levied by Reserve Bank of India (RBI) in 2018.

Cryptocurrency in India is set to open new doors for Indian investors. This is a step forward in innovation in India where everyone can be a part of the blockchain revolution.

Overturning the crypto ban in India will encourage more startups in crypto in India.

10. Economic Stimulus Provided for Cryptocurrencies : As the U.S government provides economic stimulus to boost its economy, there is growing demand for cryptocurrencies for investment purposes and are being considered as an alternative to gold because of the high returns they have provided in the recent past.

11. Medium Of Exchange for Cryptocurrencies : Countries across the world are experimenting with cryptocurrencies to use them as a medium of exchange for example China introducing its own Central Bank Digital Currency (CBDC) or Petro cryptocurrency issued by the Government of Venezuela.

12. Defi, Non Fungible Tokens for Cryptocurrencies : Defi too has grown in popularity as it empowers individuals, removes intermediaries such as banks and financial institutions and allows different parties to deal directly with each other.

The market for Non-Fungible Tokens too has already grown by over 1700 % in 2021 and large auction houses such as Christie’s are using NFTs to auction works of art.

13. Stablecoins : As there is price volatility in cryptocurrency markets, another emerging future of cryptocurrencies is stablecoins, as they provide price stability to investors and one can buy these cryptocurrencies on crypto investment apps such as , the simplest Bitcoin app, and other Indian cryptocurrency exchanges.

14. Rapid Transformations for Cryptocurrencies : With such rapid transformations in the industry, the future of crypto globally as well as in India is bright and will create opportunities for Indian entrepreneurs to enter the space and provide new job opportunities that will directly benefit the economy at large.

15. On the countries adopting cryptocurrency, they can be be categorised under the 4 broad categories-

- a.Accommodative or liberal – like in Japan.

- b.Heavily regulated like in the USA.

- c.Prohibitive, like barring financial institutions within their borders from facilitating transactions involving cryptocurrencies, like in China.

- d.Not currently regulated, like in lndia.

Slowly but steadily sentiments in favour of cryptocurrency are building in the country. In what form cryptocurrency would be acceptable to Indian lawmakers and regulators remains to be seen.

However, the good thing for crypto lovers in the country is that discussions on this topic are not dead. Rather, they are getting louder even as cryptocurrency is not fully backed by the law.

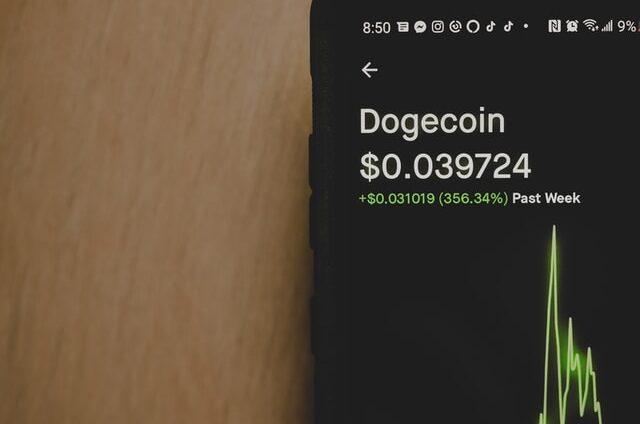

Future Of Dogecoin

After Bitcoin, crypto investors and media houses have a new favourite in town; Dogecoin. The cryptocurrency has attracted a lot of eyeballs because of its surge. It grew over 5000% in 2021, with a 400% gain in just 30 days.

These sky-high gains have stirred up many investors to buy into DOGE, a result of which is evident on platforms like CoinSwitch Kuber that are experiencing boosted engagement from its users.

But does Dogecoin really have a future…

What’s the impact and growth potential?

Hirav Shah Explains & Elaborates Below.

1. New Bitcoin- Dogecoin is the new Bitcoin. In the next few months Dogecoin may emerge as the cryptocurrency of 2021. It’s already on path, witnessing a massive surge since the start of the year. Dogecoin has given nearly 1900 per cent returns since January 2021. Yes, you read that right.

There was a time when one coin was worth less than a cent, but the recent surge has taken its value to $0.122680 or almost 12 cents. That’s incredible for a digital currency that started as a joke.

2. Massive Impact- The cryptocurrency soared to nearly 1,900 per cent since the beginning of 2021. The jump is significant given that Bitcoin has seen a surge of 117.47 percent during the same period. Yes, Bitcoin has come a long way and is tipped as the cryptocurrency that will define the future, but one cannot rule the impact Dogecoin can possibly have.

3.Started as a joke, now a phenomenon-Palmer, an Australian marketer, once joked about combining two of the internet’s most talked-about topics: cryptocurrency and Doge.

Investing in Dogecoin,” Palmer tweeted, “pretty sure it’s the next big thing.”

The tweet was noticed by a lot of influential people in the world, who started talking about Dogecoin. Started as a joke, this became a phenomenon in a very little time.

4. Unexpected Growth- Elon Musk’s favourite Dogecoin is now even bigger than his company SpaceX.

Elon Musk has invested a lot in Bitcoin, so has Tesla and Musk has been promoting Dogecoin since the beginning of this year. But, even the Dogefather would not have expected DOGE to become bigger than one of his companies. Yes, its true.

5. Dogecoin Mania- Indian cryptocurrency exchanges are now witnessing record-breaking trading volumes of Dogecoin, causing a massive surge in traffic on these platforms. This is called dogecoin mania, indeed…Opines Shah.

Final Words

Blockchain and digital assets are poised to disrupt the world as much as the internet did back in the 2000s.

And, Dogecoin is all set to steal the limelight, this year…Hirav Shah Concludes.