Table of Contents

There are three main problems around any real estate business in India

- No Stability in income

- Heavily dependent on reliable workforce

- Growth stagnation & Manual overhaul

Hang on there is more to it !!

And that’s the piling of unsold inventory, Avers Hirav Shah, Real Estate’s Most Trusted Strategist and Adviser.

There was an increase in demand and decline in unsold inventory. However, the covid-19 outbreak has put a dent in the expected recovery of the real estate sector.

The huge housing stock lying unsold in India’s major eight cities (Bangalore, Mumbai, Ahmedabad, Hyderabad, Delhi, Lucknow, Surat, Kolkata) is certainly, among several other unpleasant things, giving India’s developers sleepless nights.

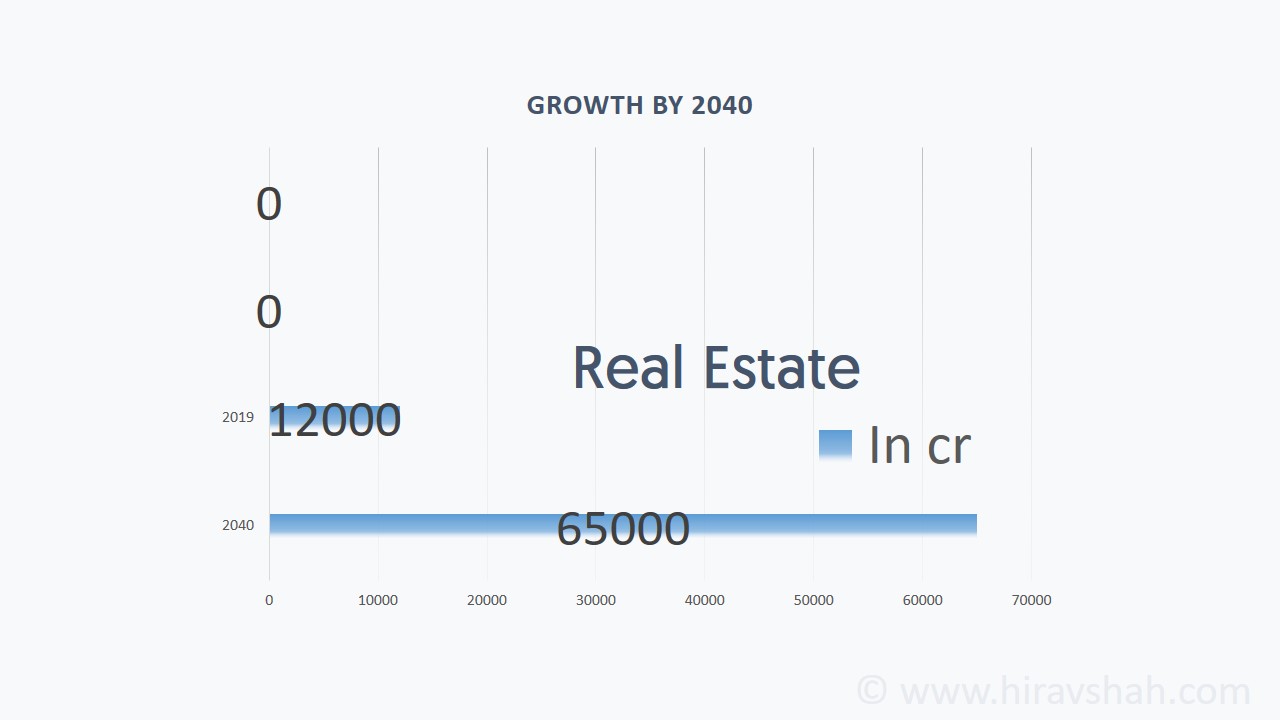

Unsold housing inventory in these cities was at over 7.18 lakh units as of December 31, 2020, as compared with the unsold inventory of nearly 7.92 lakh units in December 2019.

Which means, a big challenge in the real estate sector is indeed, a large amount of unsold inventory which makes it difficult for real estate developers to roll over the funds to start new projects, Says Hirav Shah.

Data and Analysis

1.Unsold housing inventories fell 9 per cent across eight cities by 2020 end, at 7.18 on sharp decline in new launches, but builders will now take nearly four years to clear these stocks at current low sales velocity.

2.At 48 per cent, the affordable segment contributes the highest share to the national unsold stock while nearly 19 per cent of the total unsold inventory falls in the ready-to-move-in category.

3.Mumbai and Pune continue to hold the highest share in the unsold stock with developers. However, at 72 months, the inventory overhang is the highest in the Delhi-NCR, while Hyderabad is the lowest at 29 months.

4.According to the study, the Mumbai Metropolitan Region (MMR) has the highest unsold inventories at 2,67,987 units, followed by Pune 1,21,868 units, NCR 1,06,689 units, Bengaluru 71,198 units, Hyderabad 39,308 units, Ahmedabad 38,614 units, Chennai 36,609 units and Kolkata 30,210 units.

5.Also, observed has been a 47 per cent decline, in housing sales to 3,47,586 units off late from 1,82,639 units during the previous year, while the new supply plunged 50 per cent to 1,22,426 units from 2,44,256 units.

6.However, sales rose 68 per cent to 58,914 units in the last quarter of the 2020 calendar year, compared with the previous quarter, on pent up as well as festive demand.

Ray Of Hope

1. Stable & Positive Trends

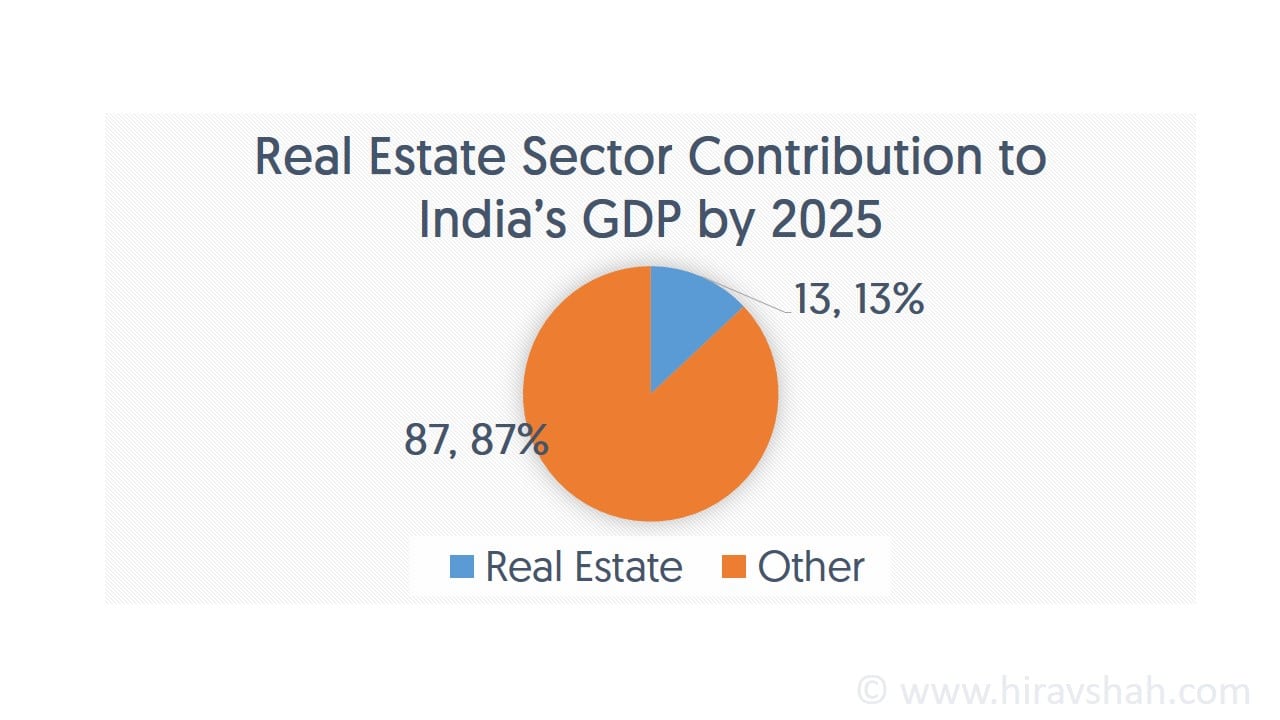

All factors considered, the sector has shown remarkable tenacity in 2021 against unprecedented odds that have caused the economy to contract and impacted consumer spending. The fact that housing sales in India’s key markets have started to bounce back, despite the general gloom caused by the pandemic, shows the immense potential of the real estate sector.

Prices continued to remain stable and the overall outlook looks positive.

While the trends point to a market recovery and positive news given the start of vaccination, that will ease the pandemic concerns, our optimism should be cautious.

Buyers continue to expect low home loan rates, extension of developer offers and prefer ready to move inventory than those under construction.

The government should continue to support the sector through moves such as lowering stamp duty, re-evaluating circle rates and increasing tax deduction limit for interest on home loans to ensure that the sector continues to revive.

2.Unsold stock has declined while inventory overhang has increased

Owing to restrained supply and buyers’ willingness to invest in ready homes, the unsold stock in these markets declined by 12% year-on-year. The unsold stock in the eight residential markets stood at 7,23,060 units lately ,as against 8,23,773 homes in March 2020.On a quarter-on-quarter basis too, unsold stock reduced by 2% in the September quarter, when compared to the preceding quarter.

However, there is huge variation in inventory overhang from the level seen last year, because of the Coronavirus-induced strain on demand caused by the economic uncertainty and weak consumer sentiment.

As against 28 months last year, inventory overhang currently is 43 months. Inventory overhang is the estimated time period within which developers will be able to sell off the current stock at the present sales velocity.

The housing markets in the west region continued to have the highest share in the overall inventory stock. Put together, Mumbai and Pune contributed 56% to the national unsold stock, followed by NCR and Bengaluru, with 15% and 10%, respectively.

Final Words

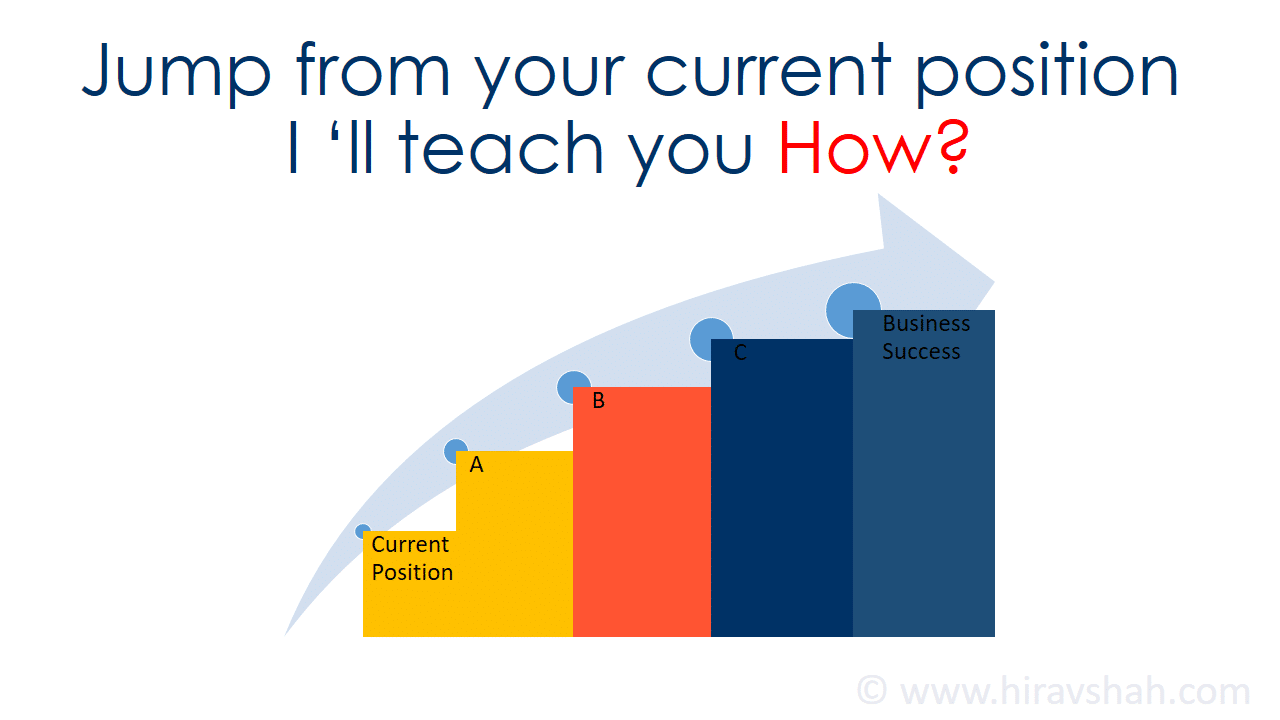

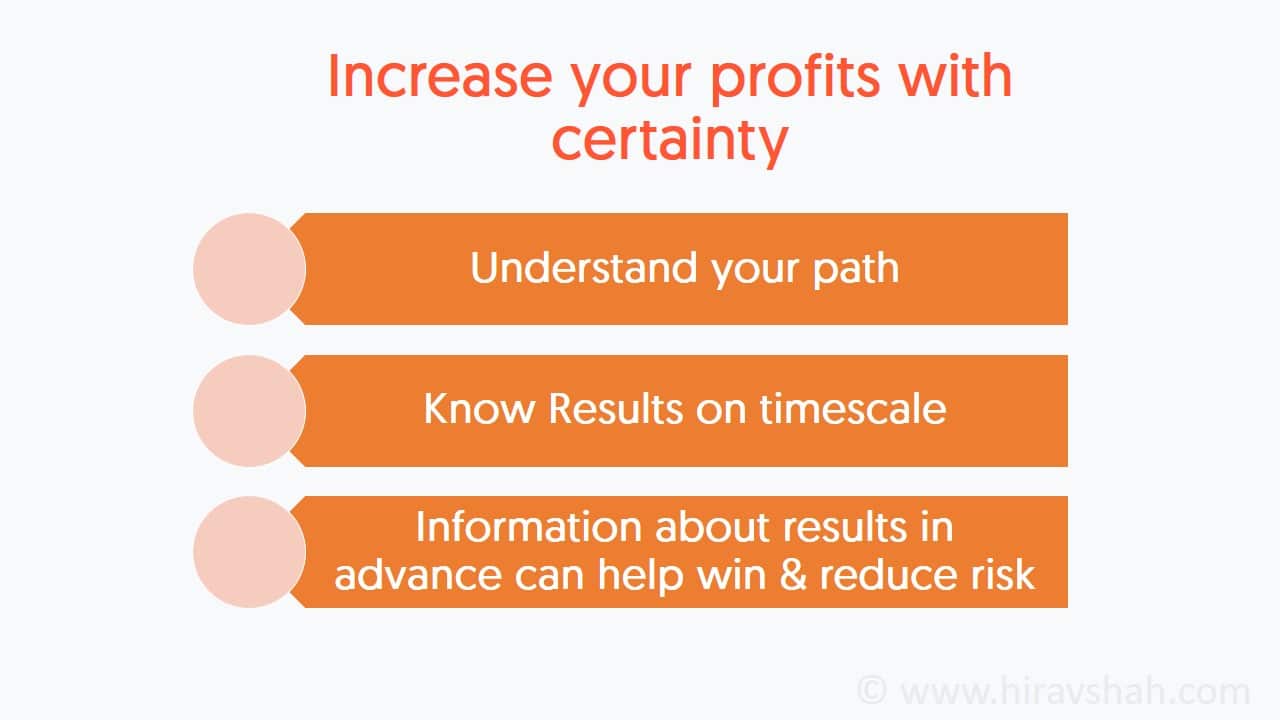

Just imagine if you get to know the SALES TIMELINE for your Unsold Commercial or Housing properties or LAND in advance Wouldn’t it be amazingly helpful for you?

That is what Hirav Shah does for you!

And this has never happened in the History of Real Estate earlier.

Sounds unreal, isn’t it.

Just to elaborate a little more…

Having managed his father’s real estate business for a short period, Hirav knows the process and struggles in and out. His expertise in providing a timeline for clearance of unsold properties or inventory is unprecedented.

So, explore Your Options With Hirav Shah.

His strategy and unique consulting services will help you formulate growth and expansion plans successfully, based on astrological analysis.